Biden Just Signaled He’s Open to Cancelling Up To $50K In Student Debt. But Wait, Can He Do That?

The stakes are as high as the legal issues are complicated.

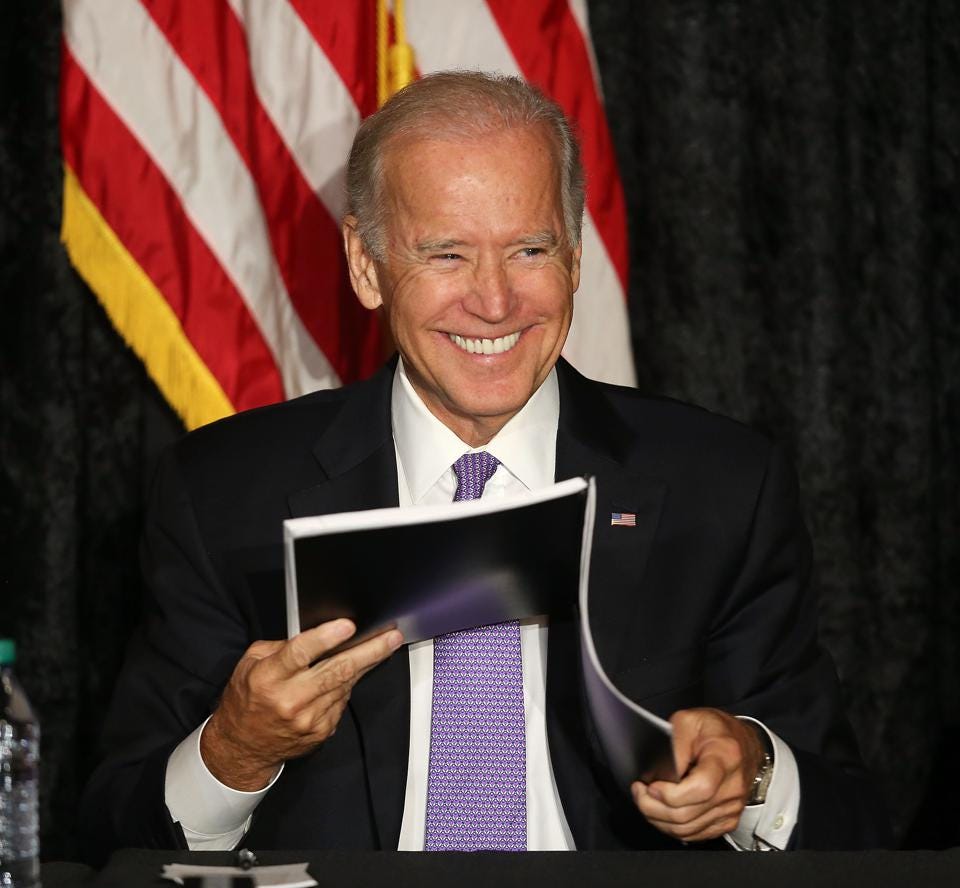

President Biden has asked Education Secretary Miguel Cardinal for a legal memo regarding his authority to cancel up to $50,000 per borrower in student debt. This is a significant step up from the $10,000 per borrower Biden had stated was his limit during the campaign and as recently as February. The question over what to do about the $1.7 trillion in federal student debt, much of it now in default, has thus taken center stage again. Calls to cancel $50,000 have found support not just among progressives like Senator Warren but also in Senate leadership, with Chuck Schumer now backing the idea. “You don’t need Congress,” said Schumer. “All you need is a flick of the pen.”

But is Schumer correct? Should we and can we simply cancel so much federal student debt? That depends on who you ask. Both sides have an array of policy and legal arguments to support their position, and the answers are not very clear once you begin to explore them.

First, the policy arguments. Those who favor student debt cancelation often note the inequities and the burdens of the debt. There are 44 million student borrowers, but two-thirds of the federal student debt is held by women. Further, around 25 percent of borrowers are presently in delinquency or default, meaning the program is already in dire straits. And there is a racial component as well: African Americans and Latinos are disproportionately affected, not only by the amount of debt they hold but by the crisis created by the pandemic recession. Proponents believe that canceling debt will stimulate the economy, help out those least able to afford their current burden, and allow a generation to start saving for their homes and their retirement.

Opponents of student loan cancellation such as former Education Secretary Betsy Devos argue that two-thirds of Americans don’t have student loans, and this amounts to a gigantic subsidy of those who still do. Further, many Americans already paid off their loans, and this would be fundamentally unfair to those that worked hard to do so. What do you tell the person who worked two jobs to be able to pay off their student loans, only to see their fellow borrowers completely forgiven? Finally, student debt cancelation, according to Devos, is aninefficient use of taxpayer money because it amounts to an un-specific wealth transfer. It’s not that the cancellation is free, she argues, it is that the cost of it has been placed upon society in general.

Even if Biden wanted to go along with debt cancellation at some level, whether it’s $10,000 or $50,000 per borrower, there is a decent argument, set out in an Office of the Legal Counsel memo back in January before Trump left office, that the president simply lacks the legal authority to do so. After all, Congress is supposed to control spending and things like the “property” of the United States, which debt falls into. Further, If Congress actually had wanted to delegate the authority to the Education Department to cancel such massive amounts of student debt, it would have done so expressly. “Congress does not hide elephants in mouseholes,” the memo noted, citing Gonzales v. Oregon, a Supreme Court case. Finally, while it seems clear that the Education Department is authorized to cancel some student debt, it must do so in limited ways and always has, according to the Memo.

Senators Warren and Schumer disagree. When the Department of Education first gained the power to issue and collect student loans back in 1958, it also received the right to “compromise, waive, or release any right” to collect on them. When the Higher Education Act of 1965 made student loan authorities permanent, it solidified that power to compromise. There is nothing in the law that prevents the Department from doing so, no matter how big the compromise, waiver or release. According to a Harvard-based legal analysis prepared at the request of Senator Warren, the only limitation on this authority is that the Secretary “may not enter into any settlement of any claim under [Title IV] that exceeds $1,000,000” without requesting “a review of the proposed settlement of such claim by the Attorney General” (citing 20 U.S.C. § 1082(b)). If Congress wanted to place more limits on the Department’s power, it had the chance and the context to do so.

Any attempt by Biden to sidestep Congress and cancel any amount of student debt will likely be met with a lawsuit by the GOP, and it will come down to how the courts—likely the Supreme Court—interprets Congress’s intent in delegating to the Secretary of Education the authority to deal with student debt. Some conservative justices might even use the opportunity to challenge the right of Congress to delegate this kind of authority in the first instance (but that’s an analysis for another day). With SCOTUS solidly in control by the conservatives, a massive student loan cancellation would go in facing skepticism and might have difficulty garnering five votes.

Practically speaking, however, a move like this would probably would cause millions of people to act as though their debt was canceled, particularly if the Department of Education indicated it would not enforce collection and would waive interest during pendency of any court challenge. The effect of this might ultimately tip the equities enough in favor of the forgiven borrowers, particularly if they made economic decisions and plans based on the assumption that the debt was canceled. The Supreme Court might not want to wade into a fight between the Executive and Congress when so many millions for so many years have relied on the debt cancellation.

Proponents of student debt cancellation have already laid one critical piece of groundwork should any cancellation occur: In the American Rescue Plan, they quietly inserted a provision that makes any debt relief received between now and 2025 non-taxable as income. If student debt cancellation becomes a reality, this provision will spare millions of borrowers the additional tax burden arising from debt relief.

Betsy has a lot of nerve talking about unspecific transfers of wealth. 45 and his entire administration, including Betsy, transferred a lot of wealth from taxpayers to themselves. I'm still sick and tired of Republicans being against anything that helps anyone but themselves.