Biden Wants Corporations To Pay Up. Here’s How To Force Them To.

A look into how large corporations with hundreds of millions in book income avoid paying any taxes.

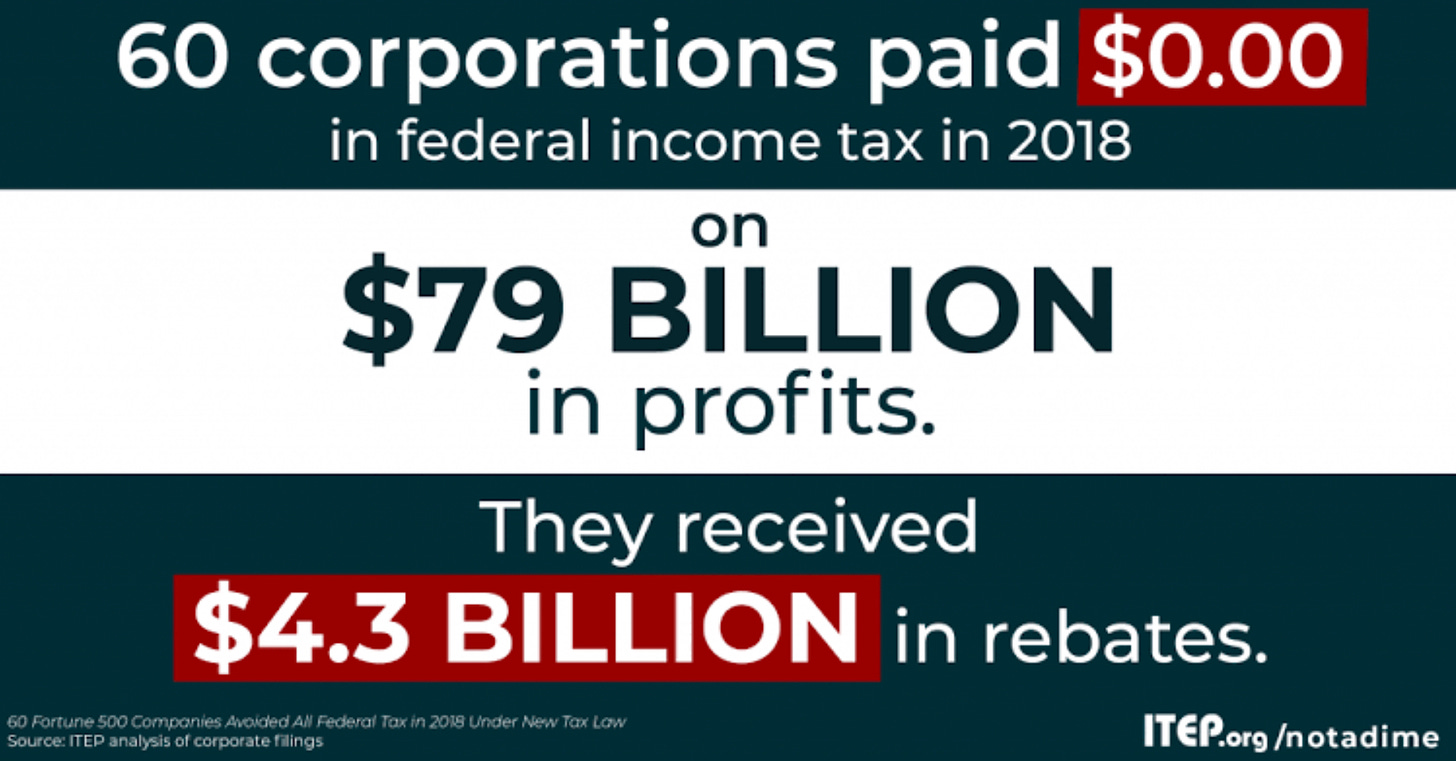

With President Biden’s announcement that the American Jobs Act will be paid for by increased taxes on corporations, moving the statutory rate from 21 percent up to 28 percent, it’s fair to ask whether that will actually generate sufficient additional tax revenue to pay for it. After all, many large corporations who are currently supposed to pay the 21 percent rate still somehow wound up paying zero taxes in 2020. How is something so completely unfair possible?

Unsurprisingly, corporations are very good at taking advantage of every tax break and loophole they can find. They have very clever accountants who know how to do things by the book, and very smart CFOs who know how to leverage the tax code to maximum effect. Some of these methods are actually beneficial, such as when companies get big tax breaks for investing in green technology. Others are a bit more controversial, as when big companies get to write off the entire cost of capital expenditures immediately rather than depreciate them over time. The 2017 Trump Tax bill allowed many corporations to write off the cost of any new equipment and machinery, for example, which spurred growth but reduced tax revenues significantly, the equivalent of a party now with a hangover later, preferably after the next election.

Some tax loopholes and methods are downright problematic, so let’s talk about two of them. The first is the widespread use of foreign subsidiaries. These are companies owned by the parent company but incorporated in another jurisdiction, say the British Virgin Islands or some other tax haven. Through clever contracting and often many layers of other companies, the foreign subsidiary winds up being the entity that earns and holds profits made internationally by a big corporation. Until these profits are “repatriated” to the United States (e.g. paid out as a dividend to the parent company in the United States) there is no tax liability on those profits. In fact, the foreign subsidiary could and often does loan money to the parent for investments made in the U.S., with the result that the parent company could actually show that loan as a liability on its books. Note that there is nothing illegal about any of this. But if we want corporations to pay their fair share, we have to tax these foreign companies as if they are domestic ones and forbid or restrict loans or other mechanisms by which profits remain un-repatriated.

A second common accounting trick is to allow top executives to buy discounted stock options in the future but deduct their value as a loss today, creating a “stock option tax break.” This can be a bit confusing, so a bit of explanation. Companies often use stock options to compensate their CEOs and other executives handsomely. Stock options are contracts that permit the holder of the option to buy a stock at a certain price, known as the “strike” price. If the stock rises, then the difference between the strike price and the current market price grows. The sleight-of-hand here is this: Companies can report these high deductions to the IRS using their stock option gaps, thereby recording much lower income than they report even to their own shareholders. According to the Institute of Taxation and Economic Policy, companies like Amazon routinely state huge expenses on their stock option gap to the IRS. In 2018 for example, that gap was $1.6 billion for Amazon. This gap can be closed through legislation, such as what has been proposed by Senator Carl Levin and the late Senator John McCain.

Returning the corporate income tax to the Reagan-era level of 28 percent will increase tax revenues, but unless the bill also closes some serious loopholes—like the use of foreign subsidiaries and stock option gaps to lower reported income—there will continue to be a highly inequitable system, and large corporations will still skate by with zero tax liability.

That’s why the Biden Administration is considering a minimum tax on corporations, similar to the Alternative Minimum Tax that certain individuals sometimes have to pay. One idea, for example, is a 15 percent minimum tax on corporations showing “book income” of at least $100 million. As proposals for tax hikes on corporations and the wealthy proceed, particularly in light of the $2 trillion price tag of the infrastructure-focused American Jobs Act, these tax proposals will be under intense scrutiny as well as pressure from corporate lobbyists. This will undoubtedly test the solidarity of the Senate Democratic Majority, which cannot afford a single dissenting vote.

Personally, I think deductions allowed over a certain level of gross profit should be discounted completely. If you're making over $10 million in profits...too bad so sad...cough up that 28%. Unless we close ALL the loopholes, creative accounting will continue to use them. I believe this is the #1 reason so many small businesses never make it. A complete rewrite of our Tax Code needs to be done.

Thank you.