So THAT’S Why He Hid His Tax Returns

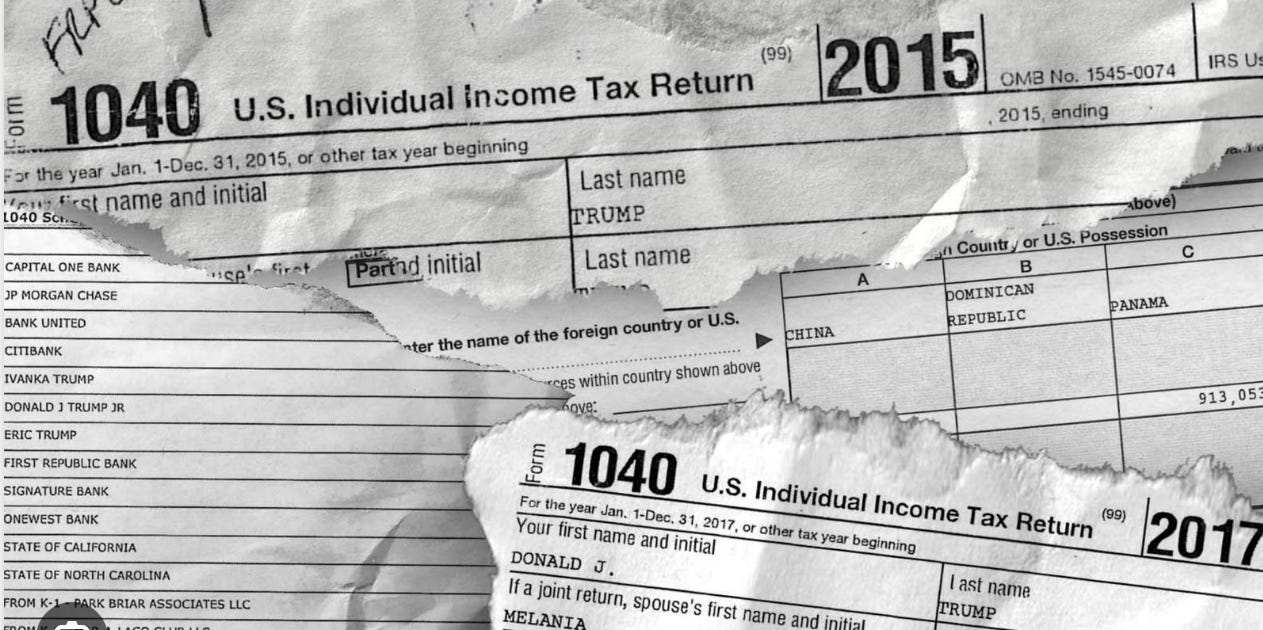

A new joint report by ProPublica and the New York Times fills in critical pieces of the Trump tax puzzle.

The long mystery around Trump’s tax returns may finally have been solved.

When Trump ran for president in 2016, he broke with tradition and refused to release copies of his tax returns. He promised he would eventually release them, but that was a lie, surprise, surprise.

We never saw them before that election, but in September of 2020 the New York Times did report at length about them, including that Trump had actually paid zero, or near zero, in federal income taxes for many years. He had claimed huge “carry-over” losses from his real estate ventures that wiped out whatever millions he had made from his TV series, The Apprentice, and from monetizing his brand.

Now it turns out, a huge chunk of those losses that Trump had claimed were very likely bogus. Over the weekend, ProPublica and the New York Times jointly reported that an IRS inquiry found Trump used a “dubious accounting maneuver to claim improper tax breaks from his troubled Chicago tower.” If he ultimately loses his long battle with the IRS, he could owe the federal government north of $100 million plus interest and penalties.

So how did Trump pull off this bogus write-off? The ProPublica / Times joint report goes into great detail, but I’ll try to explain this minus much of the financial and tax jargon.

Worthless property

At its core, the Trump tax scam comes down to basic arithmetic and a common sense rule: You can’t squeeze out more write-offs from something that’s already “worthless.”

When your business fails, you normally get to write off the value of your losses, including what you personally put into the business. At the point of failure, you can declare your business “worthless” and at least reduce your tax liability by how much you’ve lost. If your losses exceed your income that year, you can usually carry over the loss to subsequent years.

Trump took full advantage of this “worthless” declaration. He took a huge bath during the financial crisis of 2008, when he wasn’t able to sell enough condos in his Chicago tower to cover the cost of construction. Over the 825 units planned, he had only sold 133 by that time, and costs were rising. He owed his lenders hundreds of millions, and after getting a six month extension he wound up defaulting on his loans. (Predictably, Trump sued his lenders, apparently unsuccessfully, claiming the crisis was an “force majeure” that relieved him from paying the debt. He also sued them for $3 billion saying they caused the crisis.)

On his taxes for 2008, Trump took a writedown of $697 million, of which a whopping $651 million appears to have been from the Chicago tower. He included in those losses $94 million he’d invested himself plus a $557 million loan balance on the Chicago property.

Trump’s write-down came at a good time. He was able to carry over those losses and offset later income from The Apprentice and endorsement deals, which, according to the Times, took in $33.3 million in 2009, $44.6 million in 2010 and $51.3 million in 2011. That all became essentially “tax free” income, however, because of his 2008 write-off of the Chicago tower losses.

But wait, hang on! When you write down a bank loan, isn’t that income in the form of forgiven debt? Yes. The IRS normally treats forgiven loans as taxable income. After all, if you suddenly no longer owe money on a loan because it’s been written down, it’s as if you made that money because you never had to pay it back.

Trump was able to defer reporting income from his forgiven debts for years, however, under a little-known provision in the Great Recession bailout signed by President Obama. But Trump knew the bill would be coming due eventually, and he understood that needed a new way to keep reporting real estate losses to offset that massive forgiven debt.

But how to do that on a now “worthless” property?

The double dip

As an initial matter, let’s agree that the IRS should have investigated Trump’s huge $651 million “worthless” write-off that he made in 2008. Was the project really worthless? After all, Trump was trying to claim a write-off for losing someone else’s money long before that money actually was lost. And Trump was still selling condo units after that “worthless” declaration, even though the money the sales brought in didn’t cover his mounting construction costs. So was the Chicago tower really “worthless” in 2008? That’s already pretty questionable.

But what he did in 2010 is even more dubious and likely illegal, and it did become the subject of a decade-plus long IRS inquiry. For no apparent reason other than to cook the books, Trump took the entity that owned the Chicago tower and merged it into a new entity, DJT Holdings. That new company also owned many of his other properties, including his golf course resorts. Within that new holding company, Trump went on to report another $168 million in losses from the Chicago Tower—the same one that supposedly was “worthless.”

See the problem here? Something can’t be both “worthless” and get written off for taxes, and then later be worth something and entitle the owner to further write-offs. In short, Trump double dipped. He deducted $168 million from nothing.

And that likely illegal maneuver allowed Trump to avoid paying federal taxes later, even as he spread out his income from forgiven loans over many years.

The IRS and Trump

Trump’s tax returns, had they been made fully public, could have revealed this double dip that is now the subject of an IRS inquiry. They could have revealed Trump back in 2016 to have been a tax cheat who was trying to write the same losses off twice and profiting from to the tune of nine figures. That might have been election changing at the time.

Investigators at the New York Times could only glean from the tax documents reviewed that Trump had taken huge real estate tax losses, ones that carried over and allowed him to avoid paying federal income tax. They didn’t show him performing a “double dip” because, apparently, the corporate reshuffling of the Chicago tower into DJT Holdings had hidden it from plain view.

IRS battles drag on for years, sometimes over a decade, as this one has here. And we don’t know what pressures if any were brought to bear on the case while Trump was president for four of those years, but we do know that the IRS escalated the matter in 2019 and produced a lawyerly memorandum—one of only a handful it creates a year—identifying Trump only as “A” and finding that what “A” did indeed violate a law designed to prevent double dipping.

The scrutiny of the IRS into partnerships like the ones Trump set up to hide his double dipping helps explain his and the GOP’s open hostility to the IRS and their constant moves to try and defund it. Meanwhile, Trump’s lawyers are still battling the IRS over its conclusions in this matter. We know this only from a brief reference to the ongoing audit, which appeared in the Congressional Record in December 2022.

There’s no indication of when this audit might get resolved, but if the IRS holds firm, Trump could be on the hook for a lot in back taxes. As the Times noted, from 2011 to 2017, Trump paid only $643,431 on over $403 million in income, including canceled debts. This eye-popping, absurdly low figure was due to huge losses reported on his businesses, including the Chicago tower, where he had double dipped.

The conclusion? Per the Times:

The revisions sought by the I.R.S. would require amending his tax returns to remove $146 million in losses and add as much as $218 million in income from condominium sales. That shift of up to $364 million could swing those years out of the red and well into positive territory, creating a tax bill that could easily exceed $100 million.

Add that to the $454 million judgment that he owes the State of New York, and the $83.3 million he owes E. Jean Carroll, and Trump is looking very financially precarious. Trump now has a huge incentive to win the election, not only to install cronies within the Justice Department who would end his federal criminal prosecutions, but also within the IRS to end or further gum up this audit.

It would be tempting to shrug and dismiss this story as just one more Trump fraud upon the public. Instead of turning our outrage upon Trump where it belongs, many are quick to criticize the IRS for not moving faster, just as many have the Justice Department. Some of that criticism is fair and understandable, but I want readers to zoom out a bit.

Consider this: Republicans have been trying to knee-cap and punish the IRS even since Obama took office. Somehow it has been able to continue its work, in near total secrecy, and achieve an internal memorandum ruling against Trump. The ex-president has had armies of lawyers and accountants working against a severely understaffed and overwhelmed agency, but some valiant folks within it have kept the fire lit. If you are frustrated at the pace of the case’s resolution, imagine how these auditors and lawyers must feel.

To those civil servants I say this: We don’t know who you are or how many of you are on the case, but thank you for not letting this audit and this case simply disappear. For the history books, and in service of preventing similar travesties in the future, we will need a full accounting of all of Trump’s many deceptions and crimes. This one is vital one to document, and we hope you will keep holding his feet to the fire and eventually force him to pay.

Once again, since we know Trump had committed tax fraud, when can we expect to see some consequences of this for him? As well as of his recent offer of a bribe to the oil companies, which, as I understand it, is a felony? I am sure I am not the only person in the United States (or in the world) tired of waiting.

There is literally no end to his corruption.... and he keeps doing this stuff, such as the recent bribery ploy to the oil execs, because not once in his life has he been held accountable. Well except for the Carroll case which he's trying to appeal so we can't really count that as "accountable" yet. And due to this lack of accountability it makes it that much easier for his base to brush it off as not real. I mean I get his entire base thinks with only 1 brain but still. I just want to see him held accountable for something. It makes me sick to my stomach we are still talking about him as a candidate for president.