A Sham and a Scam

Don’t believe anything Trump is saying about his “reciprocal” tariffs and why we need them.

Donald Trump appeared in the Rose Garden yesterday to announce his long dreaded “Liberation Day” tariffs. No one quite knew what to expect, given his contradictory messaging and on-again/ off-again approach to tariffs so far.

Still, few expected what he actually declared: an across-the-board, minimum 10 percent tariff on nearly all imported goods worldwide, plus additional tariffs he misleadingly labeled “reciprocal” as if to imply they are in response to unfair tariffs by other countries.

These hit some nations’ exported goods with import taxes of around 50 percent. For example, China is now at 54 percent and Vietnam at 46 percent. These are staggering new levies.

The markets shuddered and dropped sharply in response, which is probably why Trump waited until after they closed to make the announcement. At the time of this writing, three hours before the opening bell on Wall Street, the S&P 500 is down 3.3 percent and the tech-heavy NASDAQ is down 3.7 percent in after-hours trading as investors worry about the global economic impact of the tariffs.

Economist Justin Wolfers pulled no punches in his assessment: “Monstrously destructive, incoherent, ill-informed tariffs based on fabrications, imagined wrongs, discredited theories and ignorance of decades of evidence. And the real tragedy is that they will hurt working Americans more than anyone else.” As you’ll see in the discussion today, Wolfers is dead on with this.

To get a full sense of it all, let’s ascend to 10,000 feet and survey the danger and the damage from a higher vantage point before dropping down for a closer look.

Tariffs are a tax, but how big are these?

Trump claims that the tariffs will raise roughly $6 trillion. Applying a typical 10 year window, that’s around $600 billion a year.

That would make it the biggest single tax hike in generations. And remember, tariffs operate as a flat, national sales tax, which means that the rates don’t “progress” with income. Middle class and working families will be hit hardest.

Broadly understood, the tariffs are a way for Trump to pay for his planned massive tax cuts for the wealthy. As Prof. Robert Reich notes in a chat with my friend Heather Lofthouse, Trump’s tariffs are a $6 trillion wealth transfer from the poor to the rich. Reich notes that tariffs are a regressive tax upon consumers, while the proposed tax cuts are designed for the wealthy. “Put those together, and you have a gigantic redistribution upward, from working people and the poor to the very wealthy. That is a scandal.”

Trump relies on revisionist history as justification

In his Rose Garden speech yesterday, Trump laid out some true revisionist doozies. He claimed, for example, that the federal government implemented an income tax in 1913 so that citizens, rather than “foreign countries” would “start paying the money necessary to run our government.”

This gets it wrong from the outset: Foreign countries do not pay tariffs, domestic importers do. They then typically pass the extra costs down to consumers. The federal income tax was a way to force wealthier Americans to shoulder a fairer, more proportionate share of the national tax burden.

Trump also claimed that the Great Depression, which began in 1929, “would have never happened if they had stayed with the tariff policy.” In fact, the Smoot-Hawley tariffs of the era are largely blamed for deepening and prolonging the misery of the Great Depression.

Trump is lying once again to the American people so that, as Prof. Reich noted, he can shift the burden of paying taxes from the wealthy to the poor by reducing the federal income tax on the former while increasing sales taxes on the latter.

How did they calculate the tariffs?

Trump went before the cameras and awkwardly held up a large sign that was labeled “Reciprocal Tariffs.” But don’t be fooled. This is not about hitting back at countries with high tariffs on U.S. goods.

The moment he held up that sign, economists and trade experts began trying to reverse engineer what it meant. The chart comprises three columns: the country, “Tariffs Charged to the U.S.A.” (including claimed “currency manipulation and trade barriers”), and “U.S.A. Discounted Reciprocal Tariffs.”

Bear with me as we dive down for a closer look into the numbers, because it’s important to understand that these are not “reciprocal tariffs” at all. And that matters because they can’t be negotiated down if they don’t exist in the first place.

These aren’t “reciprocal” anything

The first thing experts noted was that the second column in Trump’s chart was all wrong. Most of those so-called tariffs do not exist at the levels displayed. For example, as financial reporter James Surowiecki noted, South Korea does not charge us a 50 percent tariff, and the EU does not charge us a 39 percent tariff as the chart below claims.

So what gives? Where do these numbers come from? Different sources quickly calculated how they arrived at these incredible numbers. Surowiecki wrote,

They didn't actually calculate tariff rates + non-tariff barriers, as they say they did. Instead, for every country, they just took our trade deficit with that country and divided it by the country’s exports to us.

So we have a $17.9 billion trade deficit with Indonesia. Its exports to us are $28 billion. $17.9/$28 = 64%, which Trump claims is the tariff rate Indonesia charges us. What extraordinary nonsense this is.

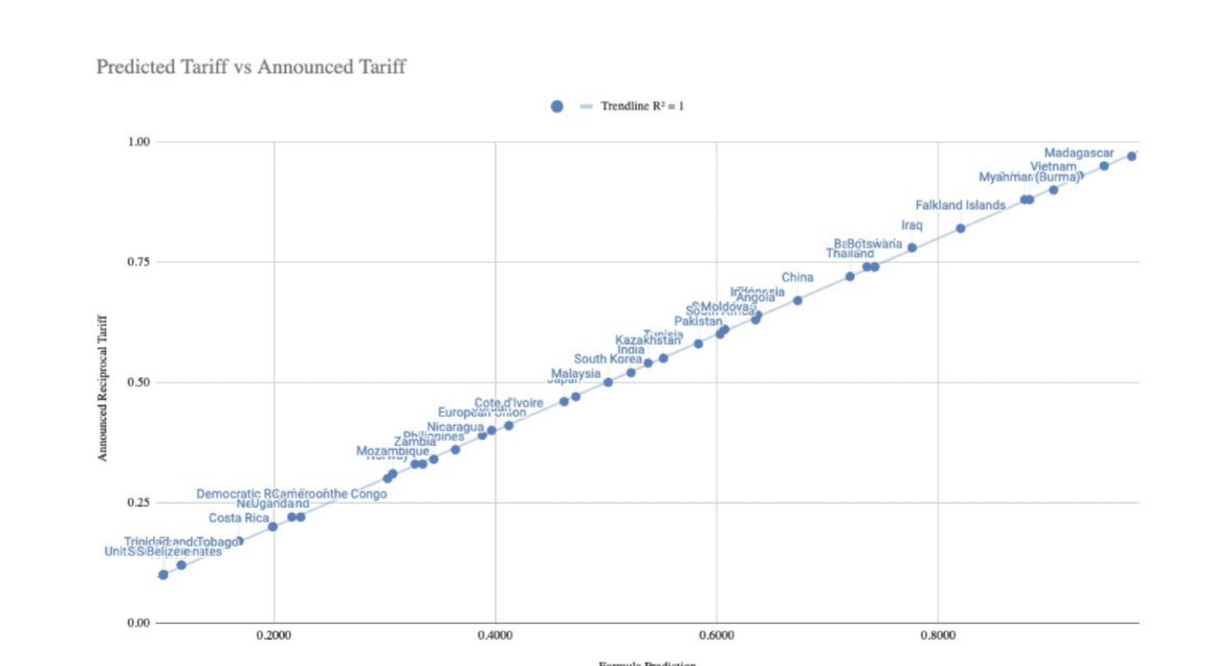

A group at Flexport also cracked the code quickly and confirmed it with hard numbers it laid out in a chart. Wrote its CEO, Ryan Petersen,

It’s quite simple, they took the trade deficit the US has with each country and divided it by our imports from that country.

The chart below shows the predictions of this formula plotted against the actual new tariff rates.

Faced with these figures, the White House confirmed that the so-called “reciprocal tariffs” were really just half the current trade imbalance. Said one Trump aide,

“The numbers [for tariffs by country] have been calculated by the Council of Economic Advisers … based on the concept that the trade deficit that we have with any given country is the sum of all trade practices, the sum of all cheating,” a White House official said, calling it “the most fair thing in the world.”

It’s also the most insane way imaginable to address trade deficits. Basic principles of comparative advantage, taught in any introductory economics college course, assume that with some countries you will run a trade surplus and others a trade deficit. Countries that manufacture cheaper goods, for example, are likely to export more to you than they import. The advantage you gain from this is cheaper prices on basic consumer goods such as clothes and toys.

Economist Wolfers sought to explain Trump’s fallacy:

Take a simple example: I run a trade deficit with Trader Joe’s buying their meals, while they buy none of mine. My trade deficit as a share of my imports is 100%.

By Trump’s trade logic, this deficit is evidence they’re imposing 100% tariffs on the meals I try to sell them.

Obviously this is nonsense.

Further, slapping a sudden 46 percent tariff on, say, Vietnam simply because it runs a trade surplus with the U.S. is bad economics. It will devastate that country’s export economy while sending the cost of their goods soaring for U.S. families.

But even worse, the numbers in Trump’s charts only calculate the trade deficit in goods, not services. The U.S. runs a trade surplus in services with the world, but that doesn’t matter in these charts at all.

Bottom line? The numbers Trump is throwing around are not really about tariffs by foreign countries at all, but rather only about our trade deficits in goods with them. They are being distorted to justify crushing tariffs that will hobble the world economy and transfer $6 trillion in goods from the poor and middle class to the wealthy.

Whom did they include and leave out?

Let’s zoom back up again. If you ever want an example of incompetence paired with corruption, look no further than these new tariffs which impose levies upon places with zero human population.

For example, they include a 10 percent tariff upon the “Heard and McDonald Islands” which have no people living on them. It’s just penguins. And the only people living within the “British Indian Ocean Territory,” which also gets slapped with a 10 percent minimum tariff, are the U.S. military personnel at the base at Diego Garcia. He’s literally taxing a U.S. military base.

It’s as if an intern went through a Wikipedia list of countries to make this chart.

But perhaps this was just some kind of administrative oversight, right? Maybe no one high up had a hand in reviewing the nations to be hit with tariffs?

That’s unlikely, given that the two countries somehow not listed are Russia and North Korea. Now, in fairness, North Korea has no substantial trade with the U.S. (and neither do the penguins at the Heard and McDonald Islands). But Russia still does billions in trade, so why is it conspicuously off the list?

Prof. Michael McFaul pointed out that, as reported by Reuters, on “Liberation Day” while Trump was busy announcing new tariffs on our allies and biggest trading partners, the White House had made arrangements for a visit by the head of Russia’s sovereign fund. He demanded an explanation for this, but one is unlikely forthcoming.

Congress could end this madness now

There’s something often overlooked in all the fear and handwringing over Trump’s tariffs: It doesn’t have to be this way. Congress, which holds the power of the purse, delegated tariff authority to the White House and has the power to take it back.

Indeed, last night four GOP senators—Sens. Lisa Murkowski (R-AK), Susan Collins (R-ME), Rand Paul (R-KY) and Mitch McConnell (R-KY) bucked their party and joined the Democrats to vote to deny Trump the power to declare a national emergency as the basis for tariffs upon Canada. The GOP-led House refuses to take up this measure, however, because it has shamefully bowed to Trump’s wishes.

By ceding its tariff authority to the Trump White House, Congress is essentially allowing Trump to impose a massive new sales tax and wealth transfer without a single piece of legislation or any kind of budget being passed. That’s not how massive tax changes are supposed to occur. The people should have a chance to be heard. There should be committee meetings and mark-ups with a chance to lobby. Instead, Trump has pulled all the power for himself, raising the possibility of corruption along the way. After all, if you want to be spared tariffs, you need only seek the grace and line the pockets of one person now.

If the economy goes into recession as prices rise from the “Liberation Day” tariffs, the blame should rest not just with Crazy Donald but his enablers in the House and Senate. They understand that this path is both foolish and dangerous but are too cowardly or too greedy to care.

And we can’t say we weren’t warned. Kamala Harris spoke frequently during the campaign about how Trump would impose what amounts to a 20 percent national sales tax upon the country:

Harris was right about Trump’s plans, but off by about $1,000 per family. As discussed at the top, the projected tax revenues from these tariffs are around $6 trillion, according to the White House. With 134 million U.S. households, and assuming a ten year period, this comes to around $5,000 per household per year.

If voters were grumbling about their personal economic outlooks and inflation before the election, they are in for a far bigger shock should these tariffs take full effect in the coming days.

Joe Biden and Kamala Harris warned us about everything the trump regime is doing and the dire consequences to follow. Corp media found it unimportant and uninteresting and didn't bother covering their prescient warnings with serious and in depth analysis. So here we are.

WHY DID TRUMP MAKE RUSSIA TARIFF-FREE?

I’M WONDERING: Maybe this is Trump‘s big fat gift (grift) to Putin - and of course Trump would expect a kickback.

Russia could buy things from, say, China without any tariffs - and then Putin would raise the price a little bit and have the goods transported to the United States and because they were now Russian goods, they’d bypass all tariffs.

Since Trump didn’t put any tariffs on Russia, this would only raise prices a little for us and most Americans wouldn’t notice - and it would be a huge windfall for Russia as ALL foreign goods would be forced to go through Putin’s hands for a price.

This would put Russia in a position to take a cut of all our imports and Putin (in a likely partnership with Trump) will become hugely wealthy like Elon - in their new role as “a paid middleman.”