The American Rescue Plan, set to be approved by the House today then sent on for President Biden’s signature, is the biggest expansion of the social safety net in America since the Great Depression. Besides providing stimulus checks and hundreds of billions in relief for states, localities and schools, it also tackles child poverty head-on with $110 billion in temporary child support payments. If the credit gets extended next year, that may be its greatest and most lasting impact.

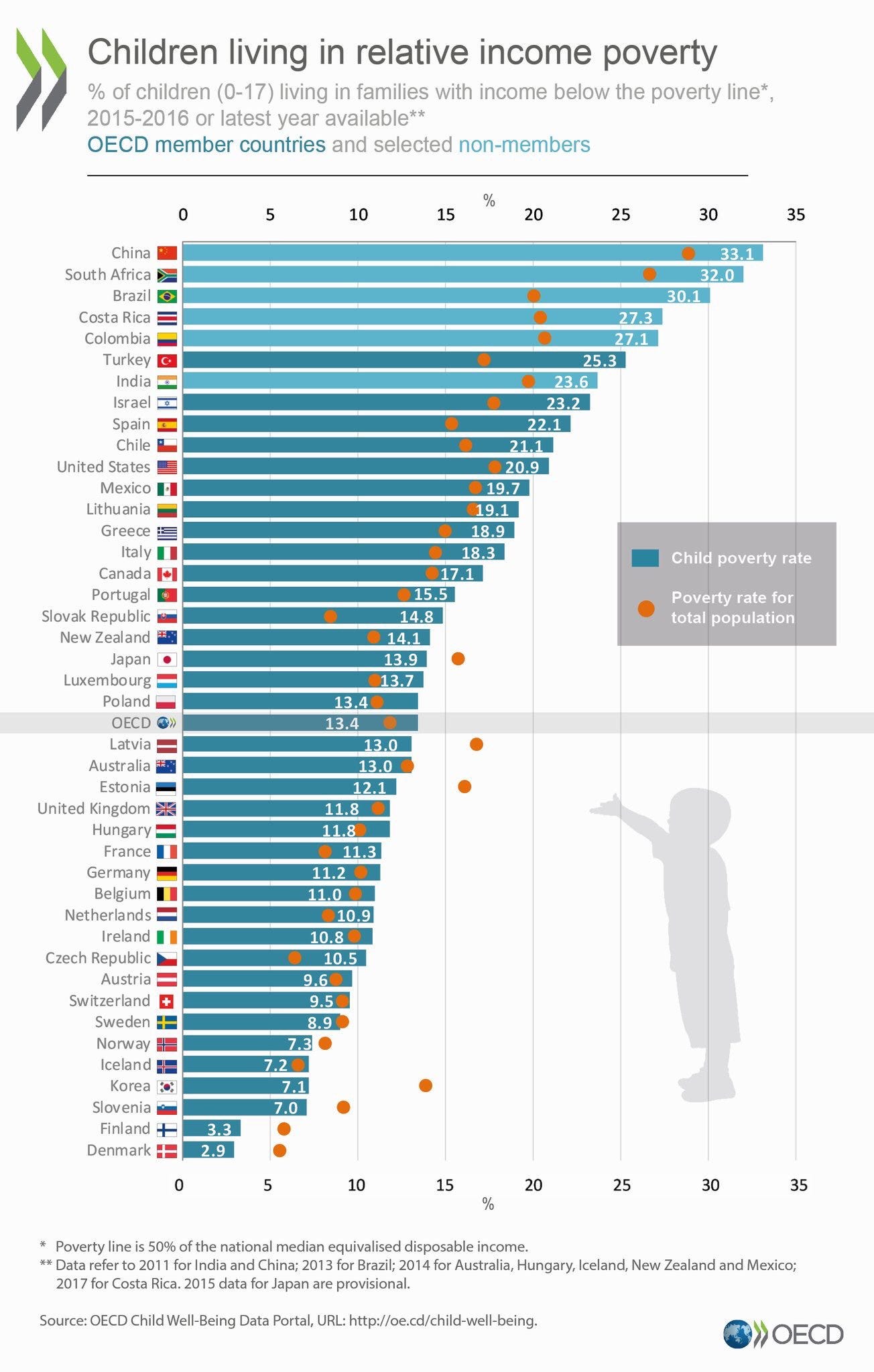

American child poverty rates are some of the worst in the developed world, with over 20 percent of American children living below the poverty line. With the increase in child tax credit from $2,000 to $3,600 per year for children under six (and $3,000 per child for children up to 17 years old), and with the granting of the credit for the first time to families that don’t even report any taxable income, the rate of child poverty will be cut by 45 percent, and for Black families by nearly 50 percent, according to experts. And importantly, checks will be sent out as advances against the credit, meaning families who typically have monthly budgets will receive the additional money periodically rather than have to wait for a big refund or check.

Republicans are already howling that the price tag is too high, and that this is nothing more than a money hand-out. “You can’t just keep adding mountains of debt at hundreds of billions at a time,” said GOP House Whip Steve Scalise. He blasted what he dubbed Speaker Nancy Pelosi’s “socialist” agenda. This is likely a theme they will test out in the 2022 midterms.

Others argue that the credits hurt families because they actually discourage parents from seeking work. Senator Marco Rubio, in a recent National Review op-ed, blasted the Biden proposal as “corrosive,” comparing it unfavorably to his own proposal for child credits tied to work. “If pulling families out of poverty were as simple as handing moms and dads a check, we would have solved poverty a long time ago,” he wrote.

Democrats say these criticisms ring false. They point to the $2 trillion tax break for wealthy individuals and corporations that Republican senators voted for in 2017 and note that the GOP didn’t worry about the cost or deficits back then. In addition, they remind Republicans that it was their party that came up with the child credit payment system in the 2017 bill. Next year, when the temporary credits expire, Democrats are hoping the GOP will be hard-pressed to vote to send millions back into poverty.

“When it’s up for renewal, Republicans will be in the awkward position of opposing payments to families delivered through a credit that they pioneered, and championed as recently as 2017,” said Samuel Hammond, director of poverty and welfare policy at the Niskanen Center. “The alternative is to rally behind some Plan B.”

That Plan B is already underway with some in the Senate, including Senator Mit Romney, who wants to increase the child support payments but make it deficit-neutral by eliminating popular government programs. That’s unlikely to gain support from Democrats, but it’s now clear there are some GOP members who understand the need to alleviate the problem of child poverty and are open to increases in the credit.

In the end, Democrats hope the child tax credit expansion is a political winner. They learned hard lessons from President Obama’s undersold reform of health care under the ACA, the results of which did not materialize right away for average working families. This permitted the GOP to attack the plan in his second year and retake the House by campaigning on a ballooning deficit.

Biden’s relief plan, by contrast, is supported by a strong majority of Americans, including 40 percent of Republicans, and poor and middle-class families will start to see their incomes rise significantly by this summer. The hope is that this will also give a boost to the pandemic stricken economy, as families in lower income brackets spend nearly everything on basic necessities. According to Bloomberg, in response to the bill’s passage, economists are now upping their projections for growth to incorporate its impact. Morgan Stanley on Tuesday raised its 2021 forecast for U.S. economic growth to 7.3% from 6.5%, a pace not seen since the Korean War boom in 1951. And the OECD more than doubled its own estimate for economic growth.

A recovery led by spending by the poorest in the country would be something not contemplated since President Reagan successfully argued, fifty years ago, that government should get out of the way and let the wealthy trickle down the economic growth. If unemployment falls off sharply while spending rises as expected, and half of U.S. children living in poverty are lifted out of it, this would be a big win-win for both the working poor and corporate employers—the kind of message Democrats are hoping could prevent the GOP from recapturing Congress in 2022.

Amazing and depressing that Republicans don't want to raise the minimum wage so they can keep the poor poor, and don't want to do anything else to help them either. Just a bunch of heartless, greedy bastards. I think the Democrats should repeal all of the Republican's tax cuts for the super rich, then let the GOP know they found the money to pay for helping a lot of Americans instead of just the few, who never needed help to begin with. Democrats also need to get better at hammering their accomplishment home for the next year. People have short memories and need to be reminded, constantly, that it was the Democrats that voted to help and the Republicans, all of them, voted not to. We'll see.

I raised 2 kids to adulthood and I can GUARANTEE that $7,200 a year would NOT have allowed me to stop working. Especially when you take into consideration saving for ridiculous college costs. Hell, one of my kids braces cost almost that much.

Ridiculous argument as usual. Smh